The journey toward redefining Islamic finance has officially begun.

Last week, DIGITAS and its venture BitSukuk proudly joined the MIFC Global Impact Challenge 2025 (MGIC AP) — a prestigious platform recognizing ventures that drive Shariah-aligned innovation and global financial inclusion.

Learning from the Best at Asia School of Business

As part of the Challenge, our team attended an intensive Crash Course in Islamic Finance hosted by the Asia School of Business (ASB) — a collaborative institution established by Bank Negara Malaysia and MIT Sloan School of Management.

The session brought together industry pioneers, academics, and innovators in Islamic fintech to discuss how digital transformation, blockchain, and Shariah principles can harmonize in creating sustainable impact.

The photo above captures one of those moments — a classroom full of forward-thinkers, entrepreneurs, and Shariah scholars bridging traditional finance with cutting-edge digital solutions.

BitSukuk: Where Innovation Meets Maqasid al-Shariah

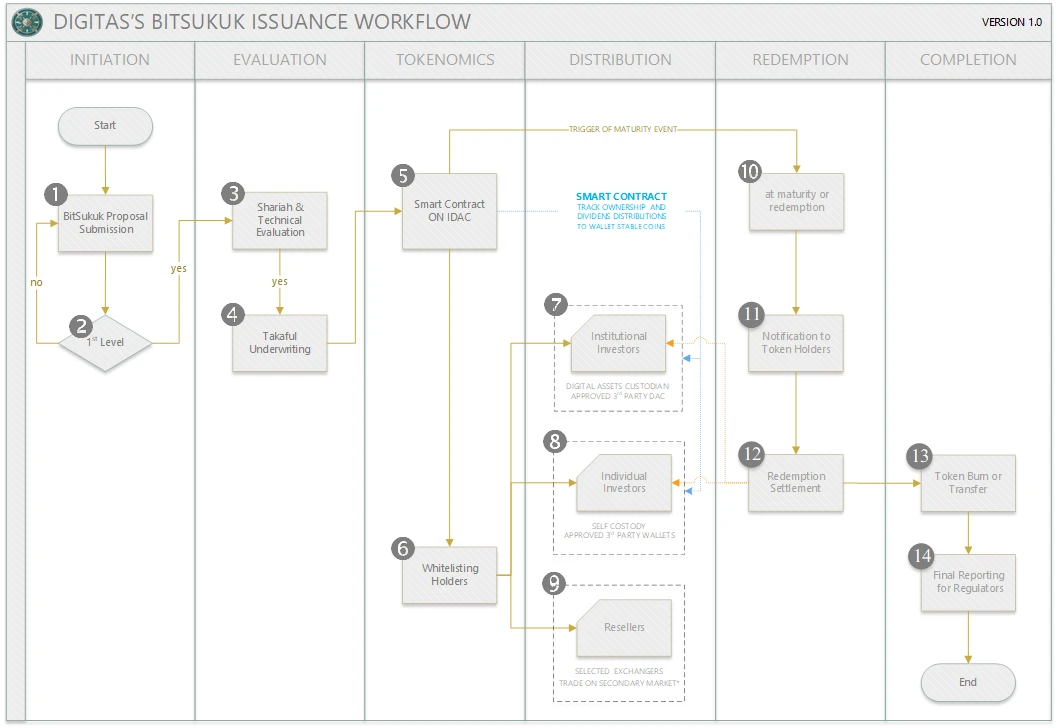

BitSukuk embodies the mission to democratize access to sukuk investments by using blockchain technology to enable fractionalized, transparent, and Shariah-compliant digital sukuk.

Through this innovation, retail investors and SMEs across the Muslim world can now participate in previously inaccessible capital markets — fully aligned with the Maqasid al-Shariah values of justice, inclusion, and equitable growth.

A Collective Movement for Impact

Beyond competition, the MIFC Global Impact Challenge represents a collective movement — uniting financial institutions, regulators, and startups to reimagine how Islamic finance can empower communities, fund sustainable projects, and position Malaysia as a global hub for Islamic digital assets.

For DIGITAS and BitSukuk, this journey is more than a milestone; it’s a commitment to shaping the next era of ethical finance — where technology, transparency, and trust converge to serve the Ummah and the world.

Comments: