click on the image to view the presentation

The MIFC Global Impact Challenge Demo Day became a landmark moment for Malaysia’s Islamic finance ecosystem, bringing innovators, regulators, and industry leaders under one roof to explore purpose-driven, technology-enabled solutions. Among the standout presentations of the day was DIGITAS’s groundbreaking introduction of BitSukuk—a digital sukuk platform built to transform how Islamic capital is raised, accessed, and governed.

The atmosphere was electric as the audience filled the hall, ready to witness how Malaysia’s fintech visionaries are shaping the next generation of ethical finance.

Maqasid al-Shariah in Action: Finance With Purpose

The showcase began with a powerful visual narrative depicting the Maqasid al-Shariah framework—emphasizing wealth distribution, transparency, and wealth protection.

A core message from the presentation was clear:

Every design decision in BitSukuk is guided by Islamic principles, right down to the platform’s accessible minimum investment threshold of RM100.

This reflects DIGITAS’s mission to democratize Islamic finance so that participation is no longer limited to wealthy or institutional investors but open to every Malaysian.

Introducing BitSukuk: The Digital Sukuk Revolution

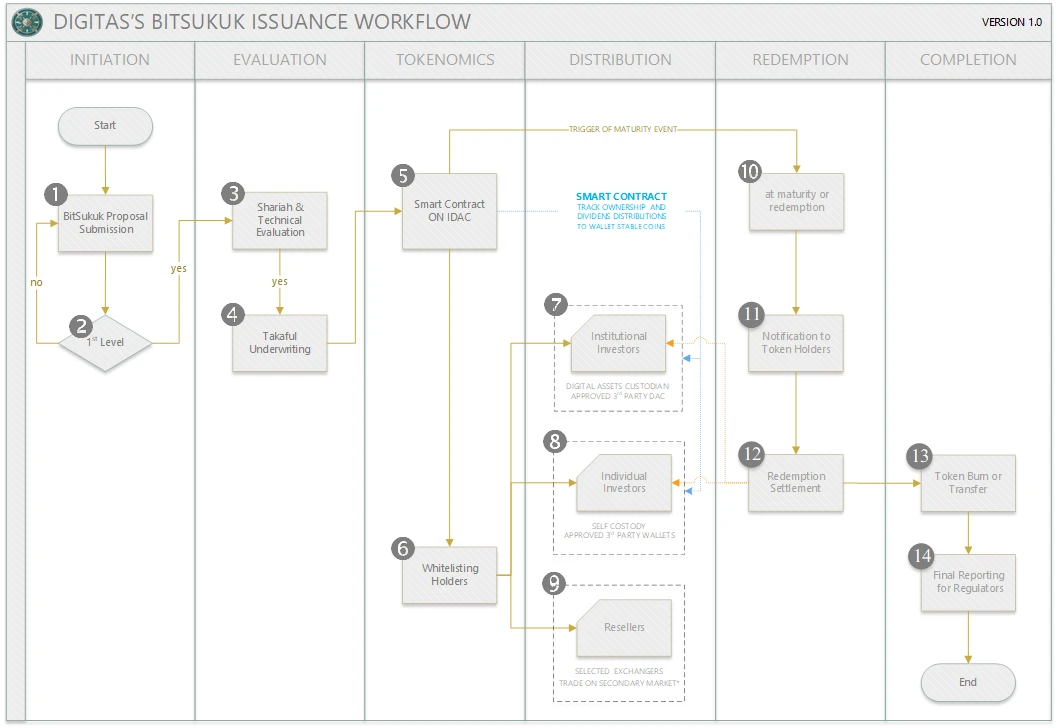

The presentation then unveiled The BitSukuk Solution, positioning it as a transformative leap from traditional sukuk structures to blockchain-native issuance.

Key highlights included:

1. Blockchain-Native Issuance

Smart contracts encode Shariah-compliant structures such as Ijarah, Wakalah, and Mudarabah, ensuring transparent and automated compliance.

2. Automated Lifecycle Management

From distributions and ownership transfers to maturity settlements—everything runs seamlessly through blockchain automation.

3. Fractional Ownership

A major breakthrough:

Retail investors can finally participate in sukuk with the same rights and protections as institutional investors.

This is a monumental step toward financial inclusion and long-term wealth creation for everyday Malaysians.

The Cost Efficiency That Changes Everything

One of the most compelling moments came during the cost comparison segment.

Traditional sukuk issuance typically ranges from RM3 million to RM5 million, creating massive barriers for SMEs, social enterprises, and smaller project owners.

DIGITAS’s BitSukuk disrupts this entirely, bringing issuance costs down to RM150,000 – RM500,000, representing up to 65% cost savings.

This isn’t just incremental improvement—it’s a paradigm shift that opens the door for thousands of previously excluded projects.

Three New Market Segments Unlocked

A major takeaway from the presentation was how BitSukuk creates three entirely new high-value markets:

-

$15 billion — Retail Investors

Everyday Malaysians can invest ethically with confidence. -

$32 billion — SME Issuers

Small and medium enterprises finally gain access to Islamic capital markets. -

$50 billion — Impact Project Financing

Renewable energy, water, housing, and social development projects gain a new funding engine.

This expansion is a strong signal that Malaysia is positioned to lead the global digital sukuk ecosystem.

Why Today’s Sukuk System Is Fundamentally Broken

The speaker delivered a striking critique of the current global sukuk landscape:

-

High costs and complexity

-

Slow issuance cycles (6–12 months)

-

High entry barriers that block 95% of Muslim investors

-

Fragmented Shariah standards across jurisdictions

These barriers don’t just exclude investors—they prevent thousands of viable, socially impactful projects from receiving funding.

BitSukuk is engineered to solve these pain points at their root.

A Strong Moment of Recognition and Support

The event also captured several human moments—warm interactions, hand signs of appreciation, and smiles shared among attendees, panelists, and presenters. These images reflect a growing sense of national pride and collective momentum.

The message projected on the main screen said it perfectly:

“May MIFC Soar Proudly for Malaysia Islamic Finance.”

DIGITAS’s presence underscored a shared aspiration:

Malaysia can and should lead the world in ethical, inclusive, Shariah-guided financial innovation.

A Gathering of Visionaries

The Demo Day concluded with group photos featuring innovators across sectors—fintech leaders, Islamic finance experts, Shariah scholars, entrepreneurs, and ecosystem partners. Their presence signified a unified commitment to pushing Islamic finance toward a global renaissance powered by digital transformation.

Malaysia’s Next Chapter in Islamic Finance Begins Here

DIGITAS’s presentation was more than a pitch—it was a call to action.

A vision where:

-

Islamic finance becomes accessible to all

-

Blockchain delivers radical transparency

-

Sukuk financing fuels national and global development

-

Malaysia stands at the forefront of fintech excellence

As the audience applauded and engaged in post-event discussions, one message echoed throughout the room:

The future of Islamic finance is digital—and Malaysia is ready to lead it.

Comments: